Why Does Nustar Energy Stock Price Continue to Decline

thitimon toyai/iStock via Getty Images

Like a doctor asking a patient to say ah for a better look, so has NuStar Energy's (NS) management said ah giving investors an opportunity for a deeper view into its future. Although NuStar continues to experience negative press about its future, we still believe that for distribution seekers, it's a worthwhile entity. So NuStar please say ah and let's go peek inside.

The Quarter

NuStar generated adjusted EBITDA of $173 million as compared to $169 million for the first quarter of '21 or about 2% higher even with the divestitures. The DCF was $91 million 13% higher than last year. Interest expense dropped by $5 million year over. Bradley Barron, CEO, added, "we've also continued to make substantial progress as promised in lowering our debt-to-EBITDA ratio. We ended the quarter with a debt-to-EBITDA ratio of 3.92x, which is down substantially when compared to the 4.39x at the end of the first quarter last year and also down from the 3.99x at the end of the fourth quarter."

Volumes, from Permian, "averaged around 510,000 barrels per day for the quarter, up 27% over the same quarter last year and comparable to the fourth quarter of 2021."

The pipelines generated $141 million in EBITDA, up $17 million or 13% more than last year. The sale of Point Tupper closed a few weeks ago adding $60 million in cash. The proceeds will used to pay down debt.

NuStar still has "$889 million available on our $1 billion unsecured revolving credit facility." We suspect that a small portion of this will be used temporarily in the near future.

Cash Growth

The key growth business for the next few years remains with the Permian Basin. Based on conversations with producers and the strong demand for oil, management expects a significant increase in product as much as another 10% (560-570 barrels per day), but not starting until the end of 2022. It also expects growth to continue during 2023 well into the 600,000s.

Growth from other portions of the business seem muted.

A Valid Plan?

NuStar's weak perceived performance seems related to four preferred stocks, Series A-D, D being the most trouble-some.

But, before we discuss NuStar's plan to exit one or more of its Series A-D preferred stock, we note this comment added by Seeking Alpha with relation to this company. It begins:

- NuStar Energy L.P. (NYSE:NS) has characteristics which have been historically associated with poor future stock performance. NS has declining growth and decelerating momentum when compared to other Energy stocks, to the point that it gets a Sell rating from our Quant rating system. Stocks rated Sell or worse by our Quant rating system have massively underperformed the S&P 500, as this article will describe.

We encourage all investors to read the entire evaluation before continuing. Sometimes long periods of slow growth spell disaster, and sometimes this spells opportunity. By the way, we fully agree with the posture of slow growth.

One of NuStar's Achilles' heels results from an issue with Series D preferred stock now callable next year. One of the of issues is that the interest rates jump to approximately 13% beginning next summer. Management engaged in a thoughtful discussion with an analyst. It begins with Theresa Chen of Barclays Bank:

"And then turning to the financing side. Can you talk about your plans to address the Series D that I believe are callable next year? And how you plan to refinance that issue?"

Bradley Barron, CEO, answered with confidence and clarity, "Sure. So as you recall, the Series D were issued in 2018, and they have a rate that goes up over time. So this has been a top priority. And as you've seen over the last couple of years, we've been positioning ourselves to take out the Series D. So the next rate increase, I think, is in July of 20[23]. That's also when they become redeemable by us. And the important part is that these are redeemable in whole or in part. And so we intend to begin redeeming these as soon as we can, which is July of 2023."

Chen then asked, "And Brad, clearly, cost savings, increasing free cash flow, your balance sheet, you have a variety of options. The common distribution is one of them, should you choose to reduce that. Is that on the table to solve the Series D issue?

Barron answered, "No, it's not. And so as I mentioned, our plan is to redeem the Series D with a combination of free cash flow, maximize through optimization. We plan to maximize our free cash flow to minimize our debt and as I've said many times, we don't need to cut their distribution, and we don't plan to."

Is there cash flow enough beginning next year to validate this CEO statement? It begins with management stating that it has "identified over $50 million in reductions across this year and next." Continuing our further look inside is a table containing our best abilities to determine the cash flows for 2022.

Cash Flow 2022 (Millions) EBIDTA $750 Interest Expense $200 Capital $130 Basic Distribution * $175 Series A-D Distribution ** $150 Net Cash $100

* 110 million shares times $1.60.

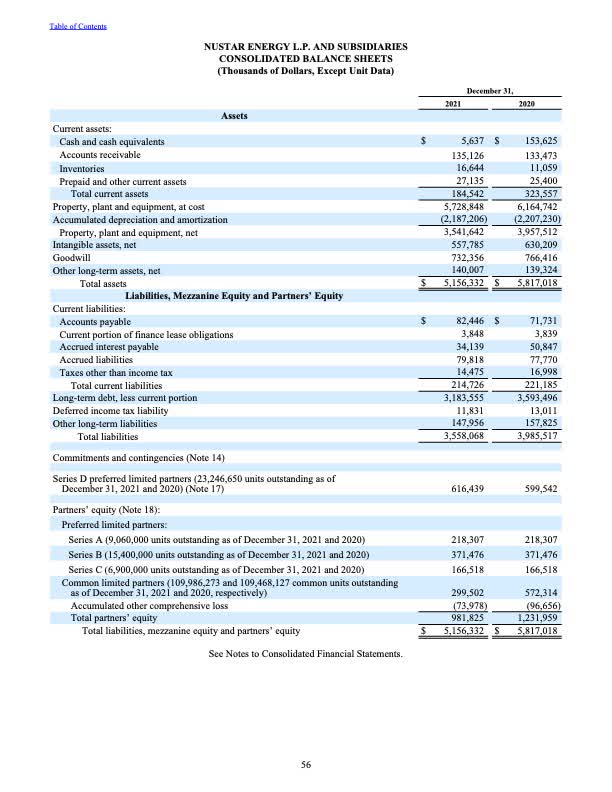

** Rounded $1.5 billion times 10%. See figure below from annual report.

We clearly note that there is a level of complexity and interest rates with all of the Series issues, so instead of detailing each, an average of 10% was used, and it represents a reasonable estimate within the realm of accuracy required.

The company continued, "We're still early in our optimization initiative, but we are encouraged by the progress we're making, having already identified over $50 million in reductions across this year and next."

It appears that by June of next year, NuStar will have set aside $150-$200 million in cash ($100 million during 2022, $50 million in the first two quarters of 2023 and $50+ million in cost savings). With the Series D noted below at approximately $600 million, it would be reduced to $400 million. If the company chose to use a small portion of its line-a-credit, it could easily pay down half. Following the next year to year and a half, the problematic series D could be extinguished, lowering interest costs by approximately $60 million when compared to 2022.

Again noted, below, the company with interest savings and other growth, the company could pay off the series C in one year.

The New Company

We included a copy of the last balance sheet reported in the 2021 annual report shown below.

NuStar 2021 Annual Report

An extinguished series D and/or series C preferred stock dramatically changes the company. Interest expenses drop by $80 million or more, allowing the company to return the lost $0.10 a quarter in distribution, changing the stock trading range from the middle teens to the low twenties. Before investors get too excited, this is a few years away, most likely 3 plus.

An Investment Strategy Continues

In the past, we have proposed selling call options to increase the return. We believe that NuStar sets in a small growth environment with the ability to pay its bill and lower the debt over the next 2-3 years by extinguishing the problematic Series D preferred shares. It will be a slow process, and investors in our view can't expect appreciation anytime soon. But the return with stock prices in the $14-$17 range at 10% plus short call premiums creates an environment for returns in the 20% range. In a coming article on GAMCO Global Gold, Natural Resources & Income Trust (GGN), we will explain further the advantage that a range-bound stock has for using this strategy. Also, we are using the call proceeds to buy other distribution paying entities and pocketing the dividend. From our view point, NuStar is worth owning under limited approaches.

Risks

Although we did our best to uncover all of the cash costs for the next few years, we may have missed some. Not being able to repurchase Series D preferred is a showstopper for at least a year. The company might be forced to drop the dividend in order to cover the preferred. If so, the price would drop significantly for a period of time. We don't expect this occurrence, but welcome comments, especially toward this issue. The company did say ah, and we did look inside. It seems that NuStar will recover slowly from this precarious circumstance shining with an increased illumination. Strategies do exist that can return viable percentages.

This article was written by

I have been an investor for several decades enduring the 87 crash, 2000 crash, and 08 crash. I do use trading systems developed with TradeStation. I have enjoyed the rewards from both buy and hold and trading. My professional experiences includes several decades as a process control engineer. I hold a JD from an eastern law school.

Disclosure: I/we have a beneficial long position in the shares of NS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4513375-nustar-energy-quandary-solved-maybe

0 Response to "Why Does Nustar Energy Stock Price Continue to Decline"

Post a Comment